Cryptocurrency started with the deflationary Bitcoin economy but evolved into an inflationary, growth-driven world of token economics.

In the appchain world, many native tokens prefer to start with inflation. They then use the extra tokens to incentivize validators to join the network and encourage users to adopt the applications.

An inflationary economy is able to incentivize growth. However, it's really important to make sure that the inflation rate matches the growth rate.

An appchain starting with high inflation could attract more staking initially, which is often lucrative for the appchain's operator because it creates a temporary token supply shortage, pushing the token price higher. However, it won't take long for high inflation to dilute the token's cap table, and excessive tokens minted from inflation will soon become additional circulating supply in the appchain's economy. If the demand is not catching up, a death spiral will be triggered as soon as the macroeconomic environment turns around.

On the other hand, an appchain's token economy is different from a company's share economy. Owning a company's shares means the right to receive dividends and owning a part of the company, while owning a blockchain's token means the freedom to use the tokens on the network - a fundamental difference.

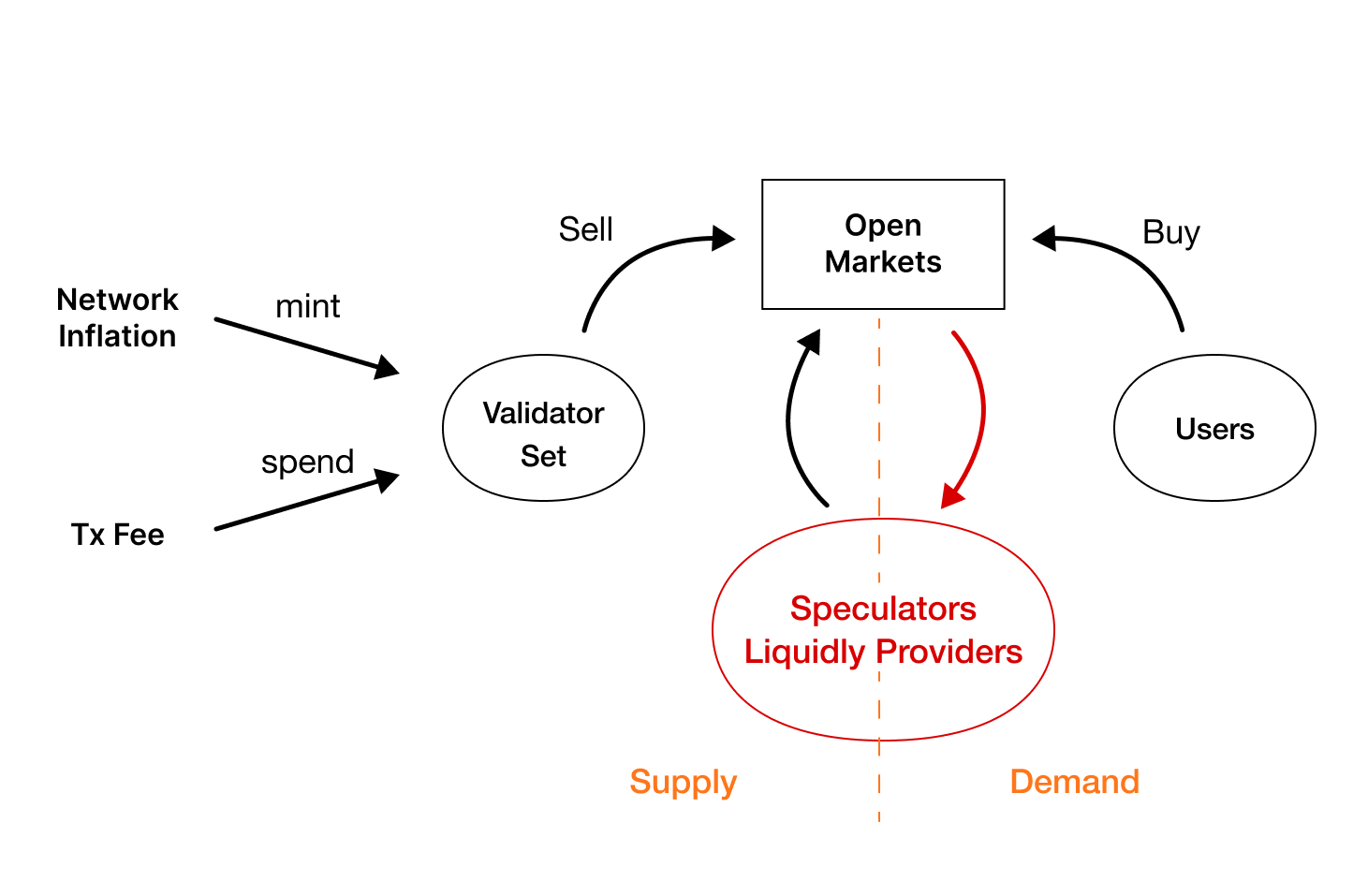

The simple long-term economics of an appchain's token is about the demand and supply of the token. For an appchain, if the 'app' is used more, then there is going to be more consumption of the token, creating demand. Without inflation, people who hold excessive tokens can sell them on the market when token prices are above their expectations, creating the only source of token supply. If the appchain is inflationary, then the newly minted tokens will be distributed via the validator set, adding additional supply.

Inflation is only healthy when there's organic growth. On an appchain, token inflation could be used to drive down the per-token price, which is beneficial for users. That is, if the demand for an application increases and the supply is limited, high inflation could drive up the cost to use the application. In that case, inflation could bring down the per-token price and ensure that the appchain remains accessible to its users.

Demand can also shrink. However, when demand is shrinking, the appchain cannot force deflation, and the best an appchain community can do is put up an on-chain governance. After all, inflation is by default a more centralized maneuver (the only exception is probably algorithmic stable coins, though these coins often need a separate governance token which could just be an appchain token). Therefore, appchain token inflation should be very deliberate. Mismanaged inflation can harm token prices significantly. Although it won't hinder users from using the application, it will hurt the project's ability to continue building. Some examples have already demonstrated this.

Non-inflationary appchain token

Given the risks of an inflationary economy, can we still use non-inflationary tokens for appchains? The answer is probably yes. The goal is to avoid highly sophisticated monetary maneuvers, which are often too much for a startup team, while keeping the token price lower for users when the application is adopted by more people.

One way to achieve this goal is via a token split. If an appchain is successfully adopted, then the token demand will naturally increase over time. The only downside of a higher token price is that using tokens on the appchain will become expensive. Therefore, based on the actual demand for the token and the growth projection of the product, token split events can be used to lower the network usage cost.

While the application grows, a token split does not need to happen very often. It could occur based on the lifecycle of an appchain.

In a non-inflationary appchain economy, the demand for the appchain's token will depend on the appchain's usage and fee structure.

Note that an appchain's total revenue might not equal transaction fee revenue. For example, the application could directly charge fees for its product without involving the native token. In this case, this part of the revenue is not directly and immediately affecting the appchain's token economy.

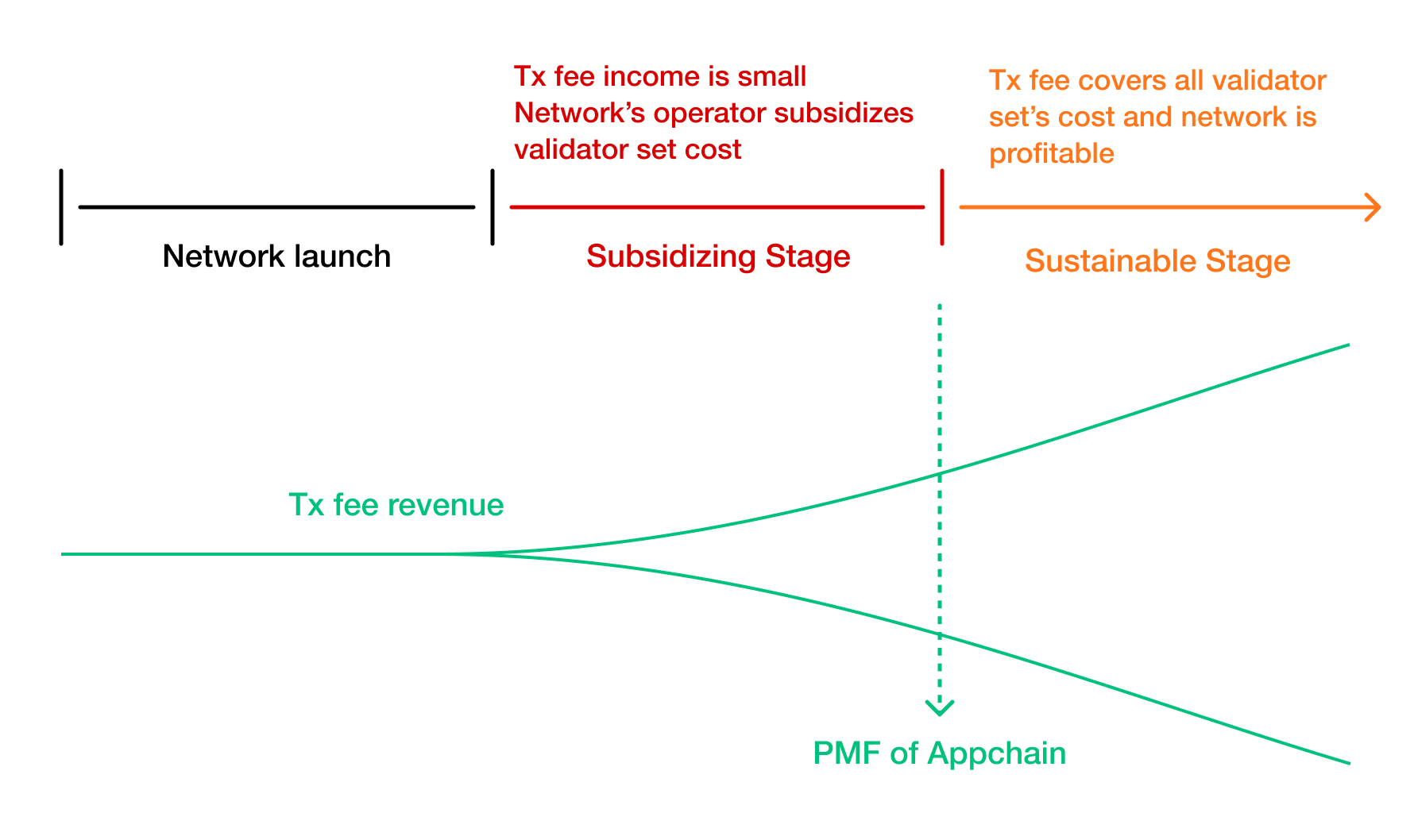

The critical moment of an appchain would be the point of reaching product-market fit. Before this point - during network launch and subsidization - there won't be a need for a token split, because there is no organic adoption of the appchain. The real demand for an appchain token will be lower than its supply. Whether an appchain could ever reach product-market fit is uncertain. This uncertainty is often mitigated by VC funding, which fills in the gap and supports the appchain through pre-PMF stages. Therefore, before reaching product-market fit, the token supply (e.g., from VC token unlock) will always exceed the demand (and this is also why a good practice for appchain ventures is to start receiving liquid tokens after the appchain reaches product-market fit).

After reaching product-market fit, the appchain can start to experience organic growth, and the token economics of the appchain will gradually become sustainable.

Token splits only need to occur after reaching the point of product-market fit. During the lifecycle of an appchain, there could be multiple token split events until the user base of the appchain saturates and its token price stabilizes.

Multiple applications

After one application becomes successful, an appchain's operator might try to build more applications.

Comment

Building multiple applications on one appchain could bring two disadvantages: (1) competition among different applications for limited block space will drive up the gas price, which is not desired nor necessary on an appchain; (2) appchain transactions could jam the appchain and make it less reliable.

Issuing multiple utility tokens can also be a bad practice. Few organizations can manage more than one utility token, just as a sovereign nation's government cannot issue two currencies.

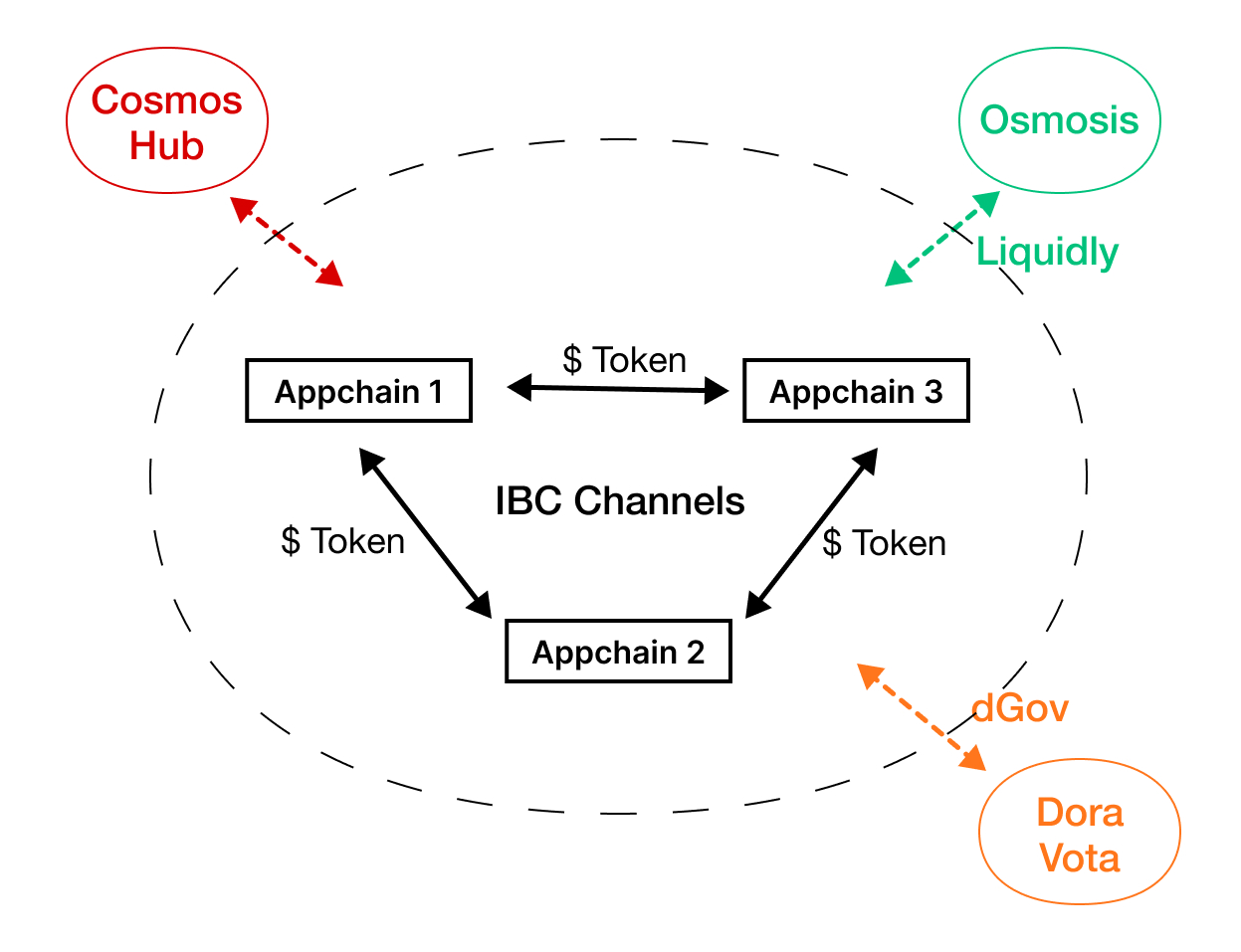

Instead, an appchain's operating organization could create multiple appchains if there is diversification in products. Tokens and assets can be transferred between these appchains via IBC channels.

Conclusion

Sovereign appchains bring freedom to application developers. However, managing an appchain's token economy is challenging. An inflationary token economy will inevitably bring centralization, even if through governance proposals. It's worth exploring non-inflationary appchain token economics, and this article presents the challenges and provides some preliminary ideas on how it might be achieved.